Yours, Mine, and Ours: The Smart Financial Move for Couples

In today’s world, the cost of living has skyrocketed, and couples are feeling the pinch. Many are choosing to stay together because of financial constraints. According to a new report, nearly one-quarter of all couples are primarily staying in their current relationships due to financial dependency. For better or worse, money plays a big role in […]

Tidy Up Your Transactions

In a world of subscription services and money-transferring apps, it is easier than ever to lose track of where your money is going. The list of streaming services is never ending, making it hard to remember what you pay for each month and if you even use the service enough for it to be worthwhile. […]

Remember These 7 Key Steps When Preparing for Retirement

Retirement is a significant life event that requires careful planning and consideration. As you approach retirement, it’s important to evaluate your financial situation and make any necessary adjustments to ensure you can enjoy your retirement comfortably. Here are some steps you can take to plan for retirement from a credit union/money perspective: Assess Your Current […]

Buy This, Not That: Things It’s Ok To Cut Costs On

Brand recognition. We all fall victim to this marketing ploy. Companies spend a lot of money to serve you commercials and ads to get you to buy the best of the best. However, sometimes the best of the best comes at a greater cost, and sometimes expensive things…are worse. We know, it can come as […]

Navigating Divorce Finances

Divorce is stressful, and it is expensive. They can tend to cost as low as $15,000 and as high as $20k for most couples. To put it into perspective, that could be the cost of a new car, a college tuition loan, and medical bills. These expenses most commonly are due to attorney fees, court […]

Tax Returns: Everything You Need to Know in 7 Steps

Tax returns are an essential part of every individual’s financial life. It is the process of submitting information about your income, deductions, and credits to the government to calculate the amount of taxes owed or refund due. Here is a step-by-step guide to help you understand the tax return process: Before you start preparing your […]

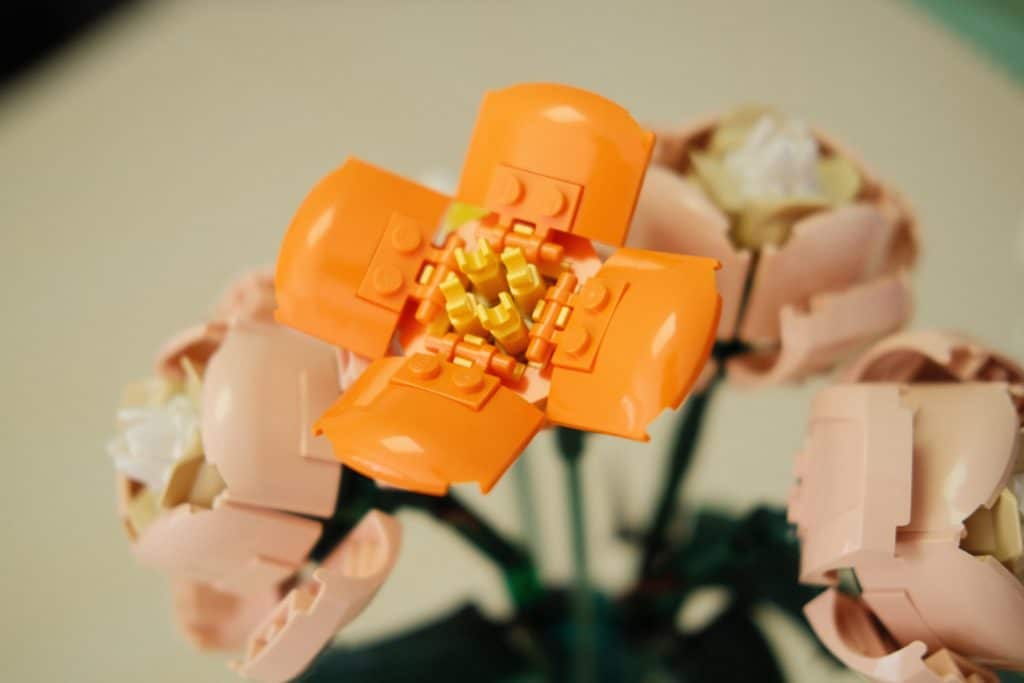

Can’t Buy Me Love: Romantic Gifts That Won’t Break The Bank

Whether you’re a fan of Valentine’s Day or not, chances are there has been a time when you wanted to get your sweetie a little something sweet. However, flowers can be expensive, and just because something costs a lot of money doesn’t mean it comes from the heart. According to the National Retail Federation (NRF), […]

Improving Your Credit Score in 3 Steps

The words “credit score” often come with a headache, especially when you’re trying to figure out how to improve yours. That’s why we’re laying out three of the best ways to rebuild or improve your credit score and set yourself up for success. While rebuilding your credit takes time, these steps will help you on […]

Don’t Buy into Impulse Buys

What kind of bells are you hearing this holiday season? If it’s warning bells instead of jingle bells, you’ve come to the right place. We all fall into the trap of impulse buys—new holiday décor, something perfect for a friend who wasn’t originally on your list, or something on incredible sale—and these, ultimately, only lead […]

Buy Now Pay Later: Is It Worth It?

Buy now pay later, also known as BNPL, sounds pretty attractive. This is particularly true with the state of the current inflation rate in the economy. The idea that you, as a consumer, can figuratively have your cake and eat it too when it comes to holiday shopping sounds too good to be true! Until […]